For those looking to make the most of their investments, a mortgage investment calculator can be a powerful tool. It helps investors assess the costs associated with taking out a mortgage and determine the expected return on their investment. This calculator allows potential investors to consider specific variables that can affect their financial decisions and plan accordingly. The calculator takes into account factors such as loan amount, interest rate, property taxes, insurance costs, and other expenses associated with owning real estate.

If you’re planning to invest in a mortgage, it’s important to know the details of your investment. A mortgage investment calculator is an invaluable tool that can help you understand the return on your investment and estimate potential risks.

This type of calculator is highly versatile, allowing you to calculate monthly payments, amortization schedules, and other important metrics for any given loan amount. It will also provide an estimated after-tax return for each month and the total expected return over time. With this information in hand, you’ll be able to make smarter decisions about which mortgages are right for your portfolio.

Using a mortgage investment calculator is easy and straightforward – simply input the loan amount into the calculator, and let it do the rest!

Mortgage Investment Calculator

Do not Add Loan amount it will automatically add after the calculation

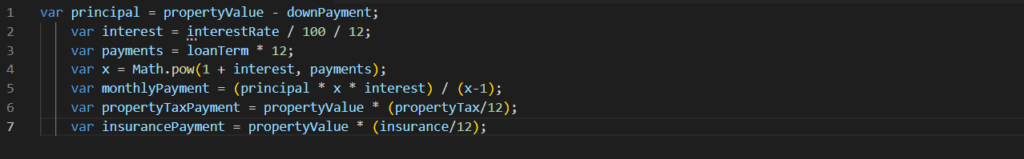

Mortgage Investment Calculator Logic