Are you considering taking out a mortgage loan to consolidate your debts? Do you want to know the potential savings or costs of such an action? A Mortgage Consolidation Calculator can provide you with these answers. This article will explain what a Mortgage Consolidation Calculator is and how it works. It will also detail the advantages and disadvantages of using one, as well as other important information you should be aware of when deciding whether this type of calculator is right for you.

Mortgage consolidation calculators are an invaluable tool for homeowners looking to reduce their mortgage debt. With a few simple inputs, these calculators provide clear and accurate estimates of the cost of consolidating multiple mortgages into one loan. By doing so, not only will borrowers save money by reducing the total amount of interest being paid over the life of the loan, but they can also simplify their monthly payments with one single payment each month.

By entering details such as current loan balances, interest rates, and remaining terms into a mortgage consolidation calculator, borrowers can quickly compare different scenarios to determine which option best meets their financial needs. Not only does this help borrowers calculate how much they will save on interest payments in the long-term, it also provides clarity around what new monthly payment amount should be expected when consolidating multiple loans into one.

Mortgage Consolidation Calculator

New Monthly Payment: $

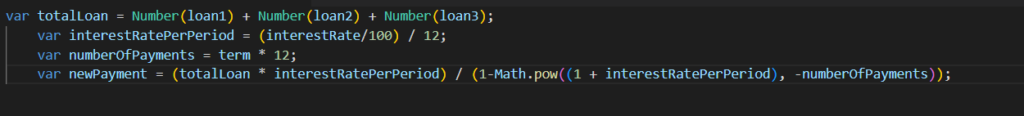

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

M = monthly payment

P = the principal amount of the loan (the total amount of all the loans combined)

i = the interest rate per period (monthly interest rate)

n = the number of payments (term of the loan in months)

Mortgage Consolidation Calculator Logic

It’s important to note that this is a rough estimate and does not take into account all the complexities of the real-world scenarios, such as taxes, insurance, and other costs.