Are you looking to determine the best mortgage payment frequency for your financial needs? If so, then you have likely come across a mortgage calculator that can help you decide between making weekly or monthly payments. In this article we will discuss the advantages and disadvantages of each option, as well as how a mortgage calculator can help you make the best decision for your current financial situation. We’ll also take a look at some other factors that may influence your choice of payment frequency.

Mortgage Calculator Weekly vs Monthly payments can be a daunting task to calculate, however they are both important in different ways. A Mortgage Calculator is an essential tool for potential homeowners as it helps them to budget and plan their finances accordingly. The primary difference between the two payment schedules is that with weekly payments, you pay more frequently but with smaller amounts of money each time, whereas monthly payments involve larger sums but less often.

Weekly mortgage payments may be beneficial for those who receive their income on a regular basis, such as bi-weekly or fortnightly paycheck earners, as it allows them to keep up with their repayments without having to wait until the end of the month. On the other hand, monthly mortgage repayments can help homeowners keep better track of their overall financial commitments and provide an easier way to budget and plan expenses accordingly.

Mortgage Calculator Weekly vs Monthly

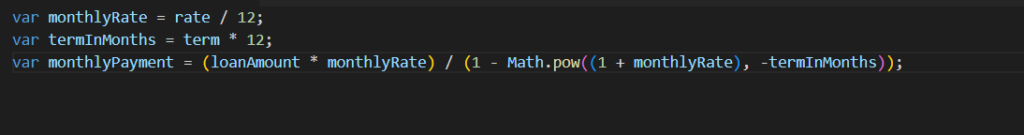

Mortgage Calculator Weekly vs Monthly Logic