Are you self-employed and looking to purchase a home? Are you having trouble finding the right mortgage calculator for your needs? Worry no more, this article is here to help! Mortgage Calculator Self Employed provides a comprehensive calculation of all the elements needed in order to get the best mortgage rate. It takes into account your income and expenses, tax deductions, retirement plans and other investments. With this calculator, you can explore different scenarios to determine which loan plan suits your financial situation best.

Mortgage calculators offer invaluable insight into the affordability of a loan for self-employed individuals. For those who are not employed with a traditional job, using a mortgage calculator can help determine their financial eligibility and ability to take out a loan. With this in mind, it is important to understand how these tools work and what they can do for those who are self-employed.

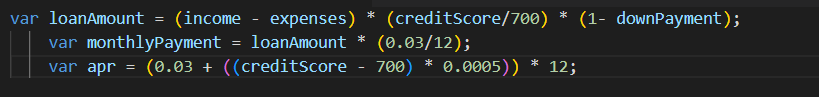

A mortgage calculator for the self-employed is designed to assess an individual’s financial eligibility based on their income and expenses. The tool requires input from the borrower such as income sources, debts, current assets and liabilities, credit score and other debt obligations, among others. After inputting this information into the tool, it will provide an accurate assessment of how much money one can borrow and what type of interest rate they qualify for given their financial circumstances.

Mortgage Calculator Self-Employed With Income

Mortgage Calculator Self-Employed With Income