Are you considering buying a home, but aren’t sure how much it will cost? A mortgage buy down calculator can help you understand the financial implications of purchasing a home and make an informed decision. A buy-down calculator allows you to input the details of your prospective mortgage loan and see the estimated monthly payments for different mortgage rates. It also shows the total amount paid over the course of your loan term and the interest savings associated with buying down your rate.

A mortgage buy-down calculator is an essential tool in the home-buying process, allowing potential buyers to calculate how much money they can save by lowering the rate on their mortgage loan. The calculator provides individuals with a better understanding of the costs associated with buying down their mortgage rate and helps them determine whether or not it is a financially viable option for them.

The mortgage buy-down calculator works by considering several factors, such as the initial loan amount, duration of the loan and current interest rate. It also adjusts for origination fees that may be charged to lower your interest rate and any points that you may need to buy in order to secure a lower rate. By inputting all these values into the calculator, potential buyers can get an accurate estimate of how much they can expect to save over time by securing a mortgage at a lower rate.

Mortgage Buy-Down Calculator

New Monthly Payment: $

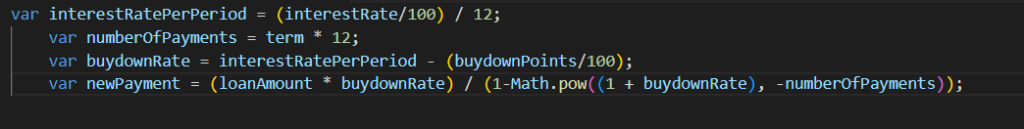

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where: M = monthly payment P = the principal amount of the loan i = the interest rate per period (monthly interest rate) after the buydown is applied n = the number of payments (term of the loan in months)

Mortgage Buy-Down Calculator Logic