Are you considering taking out a loan to finance your business? If so, then the Funding Circle Loan Calculator is an invaluable tool. This calculator offers a simple and straightforward way to evaluate the cost of taking out a loan. With the calculator, you can quickly estimate the monthly payment, annual percentage rate (APR), and total loan cost. This article will provide a comprehensive guide on how to use the Funding Circle Loan Calculator to make an informed decision regarding your loan options.

Funding Circle Loan Calculator is a tool that makes it easy for businesses to understand their financing options. It provides an accurate estimate of the loan amount and repayment term that will work best for a business’s unique needs. Business owners can use this calculator to get estimates on their loan size, repayment terms, and more – all with the click of a button.

The Funding Circle Loan Calculator is simple and straightforward to use. All users need to do is enter some basic information about their business including revenue, cash flow, and other financial details in order to receive an accurate calculation of their potential funding options. The calculator also features helpful comparison tools so businesses can compare different types of loans side-by-side before making a decision.

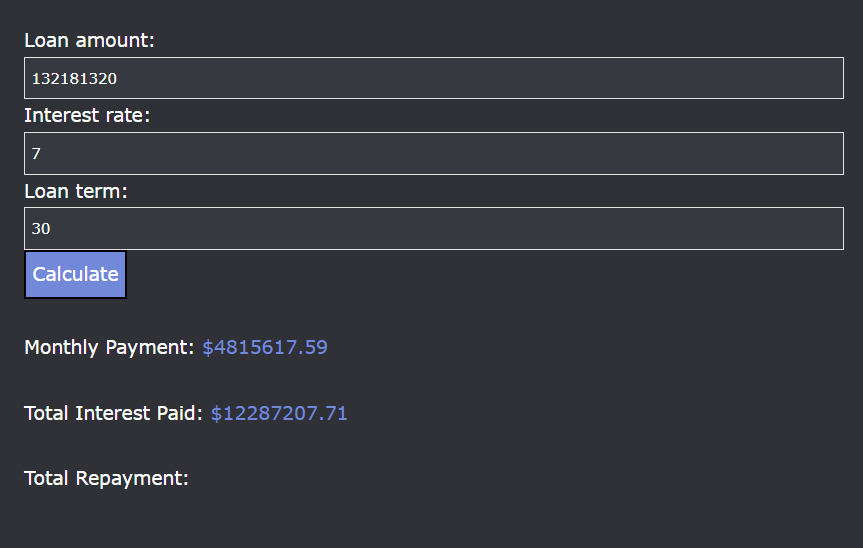

Funding Circle Loan Calculator

Monthly Payment:

Total Interest Paid:

Total Repayment:

Funding Circle Loan Calculator Example

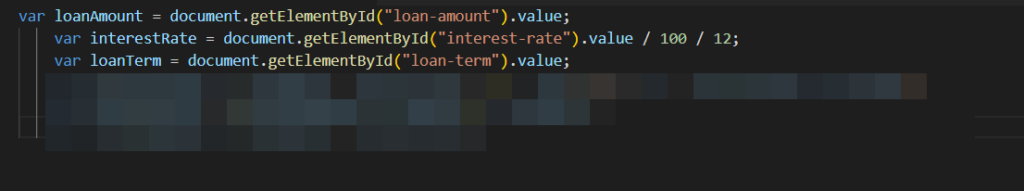

How to Calculate Funding Circle Loan

Introduction

Small and medium-sized businesses are the backbone of the economy, creating jobs, generating wealth, and driving innovation. However, one of the biggest challenges that these businesses face is access to financing. Traditional banks can be hesitant to lend to small businesses, especially those that are still in their early stages or lack a solid credit history.

This is where alternative lenders like Funding Circle come in. Founded in 2010, Funding Circle is a peer-to-peer lending platform that connects small businesses with investors who are looking to lend money. Since its inception, Funding Circle has helped thousands of businesses in the US and UK access the capital they need to grow and expand.

In this comprehensive guide, we will provide an in-depth look at Funding Circle loans, including their types, application process, approval criteria, rates and fees, repayment terms, and more. We’ll also explore the benefits and drawbacks of Funding Circle loans, how they compare to traditional bank loans, and alternative financing options. By the end of this guide, you’ll have a thorough understanding of Funding Circle loans and whether they might be the right financing option for your business.

Types of Funding Circle Loans

Funding Circle offers a range of financing options for small and medium-sized businesses, including:

Business Term Loans

Business term loans are a popular financing option for businesses that need a lump sum of money to fund a specific project or purchase. These loans have a fixed repayment term, typically ranging from six months to five years. Funding Circle offers business term loans with loan amounts ranging from $25,000 to $500,000.

Revolving Lines of Credit

Revolving lines of credit are a flexible financing option that allow businesses to access funds as they need them, up to a certain credit limit. Unlike a term loan, there is no fixed repayment term for a revolving line of credit. Instead, businesses make monthly interest payments on the amount they borrow and can pay down the balance at any time. Funding Circle offers revolving lines of credit with credit limits ranging from $6,000 to $500,000.

Asset Finance

Asset finance is a type of financing that allows businesses to purchase equipment or other assets without having to pay the full cost upfront. Instead, the asset serves as collateral for the loan. Funding Circle offers asset finance loans with loan amounts ranging from $5,000 to $500,000.

Each of these Funding Circle loan types has its own unique features and benefits, allowing businesses to choose the financing option that best meets their specific needs.

How to Apply for a Funding Circle Loan

Applying for a Funding Circle loan is a straightforward process that can be completed entirely online. Here are the steps involved:

Step 1: Check Your Eligibility

Before applying for a Funding Circle loan, you’ll need to check your eligibility. To be eligible for a loan, your business must:

- Be based in the US or UK

- Have been in operation for at least two years

- Have an annual revenue of at least $150,000 (US) or £100,000 (UK)

- Have no bankruptcies or tax liens in the past five years

- Have at least two years of filed accounts (UK only)

Step 2: Gather Your Documents

To complete the loan application, you’ll need to provide some basic information about your business, as well as some supporting documentation. Here are some of the documents you’ll need:

- Business tax returns for the past two years

- Personal tax returns for the past two years (for all business owners with more than 20% ownership)

- Bank statements for the past three months

- Business financial statements (income statement, balance sheet, cash flow statement)

- Business debt schedule (if applicable)

- Photo ID for all business owners

Step 3: Complete the Online Application

Once you’ve gathered all of your documents, you can begin the online application process. The application typically takes around 10 minutes to complete and asks for information about your business, including its legal structure, industry, and credit history.

Step 4: Wait for Approval

After you submit your application, Funding Circle will review your application and supporting documentation. If your application is approved, you’ll receive a loan offer within a few days. You’ll have the opportunity to review the terms of the loan and decide whether to accept the offer.

Step 5: Receive Funding

If you accept the loan offer, you’ll receive the funds within a few days. Funding Circle typically deposits the funds directly into your business bank account.

By following these steps, you can apply for a Funding Circle loan and potentially receive the funding you need to grow your business.

Funding Circle Loan Repayment

Repaying a Funding Circle loan is a simple and straightforward process. Here’s what you need to know about Funding Circle loan repayment:

Repayment Term

Funding Circle loans have fixed repayment terms that typically range from six months to five years. This means that you’ll know exactly how much you’ll need to pay each month and for how long.

Repayment Schedule

Repayments on a Funding Circle loan are typically made on a monthly basis. You’ll need to make your payments on time to avoid late fees and potential damage to your credit score.

Automatic Payments

Funding Circle offers the option to set up automatic payments, which can help ensure that you never miss a payment. You can choose to have your payments automatically deducted from your business bank account each month.

Early Repayment

If you’re able to pay off your Funding Circle loan early, you can do so without incurring any prepayment penalties. In fact, Funding Circle encourages early repayment and offers a discount on the remaining interest if you pay off your loan early.

Late Payments

If you’re unable to make a payment on your Funding Circle loan, you should contact Funding Circle as soon as possible to discuss your options. Late payments can result in late fees and potential damage to your credit score.

Default

If you’re unable to make your loan payments for an extended period of time, your loan may go into default. This can result in legal action and potential damage to your credit score.

By understanding the repayment process for a Funding Circle loan, you can make sure that you’re able to make your payments on time and avoid any potential issues.

Funding Circle Loan Rates and Fees

Funding Circle offers competitive rates and fees for its loans, which vary depending on a variety of factors. Here’s what you need to know about Funding Circle loan rates and fees:

Interest Rates

Interest rates on Funding Circle loans start at 4.99% and can go up to 27.79%. The interest rate you’re offered will depend on a variety of factors, including your creditworthiness, the amount of the loan, and the term of the loan.

Origination Fee

Funding Circle charges an origination fee on its loans, which is a one-time fee that is deducted from the loan amount before it’s disbursed to you. The origination fee ranges from 3.49% to 6.99%, depending on the loan term and your creditworthiness.

Late Payment Fee

If you miss a loan payment, Funding Circle charges a late payment fee of 5% of the missed payment amount or $25, whichever is greater.

Insufficient Funds Fee

If you don’t have enough funds in your bank account to cover a loan payment, Funding Circle charges an insufficient funds fee of $15.

Prepayment Discount

Funding Circle offers a prepayment discount if you pay off your loan early. The discount varies depending on the remaining term of the loan and can be as much as 25% of the remaining interest.

Other Fees

Funding Circle doesn’t charge any other fees for its loans, such as application fees or maintenance fees.

By understanding the rates and fees associated with a Funding Circle loan, you can make an informed decision about whether it’s the right financing option for your business.

Benefits of Funding Circle Loans

Funding Circle loans offer a variety of benefits for small business owners looking for financing. Here are some of the key benefits of Funding Circle loans:

Competitive Rates and Fees

Funding Circle offers competitive interest rates and fees for its loans, making it an attractive financing option for small businesses.

Fast and Easy Application Process

The application process for a Funding Circle loan is fast and easy, with most applicants receiving a decision within 24 hours.

Flexible Loan Terms

Funding Circle offers flexible loan terms that range from six months to five years, allowing you to choose a term that works best for your business.

No Prepayment Penalties

Funding Circle doesn’t charge any prepayment penalties if you pay off your loan early, which can save you money in interest payments.

Transparent and Simple Repayment Process

The repayment process for a Funding Circle loan is transparent and simple, with fixed monthly payments and no hidden fees.

Personalized Customer Service

Funding Circle offers personalized customer service to help you navigate the loan application process and answer any questions you may have.

Access to Capital

Funding Circle provides access to capital that can help you grow and expand your business, whether you need funds for inventory, equipment, or other business expenses.

By considering the benefits of a Funding Circle loan, you can make an informed decision about whether it’s the right financing option for your business.

Drawbacks of Funding Circle Loans

While Funding Circle loans offer many benefits, there are also some drawbacks to consider before applying for financing. Here are some of the potential drawbacks of Funding Circle loans:

Strict Eligibility Requirements

Funding Circle has strict eligibility requirements, including a minimum credit score of 620, a minimum of two years in business, and a minimum annual revenue of $150,000. This can make it difficult for some small businesses to qualify for a loan.

Lengthy Application Process

While Funding Circle offers a fast decision time, the application process can be lengthy and require a lot of documentation.

Collateral Requirements

Funding Circle loans may require collateral, such as business assets or a personal guarantee, which can put your personal assets at risk if you’re unable to repay the loan.

Potentially High-Interest Rates

While Funding Circle offers competitive interest rates, some borrowers may still receive rates that are higher than they can afford.

Origination Fees

Funding Circle charges an origination fee on its loans, which can add to the overall cost of borrowing.

Late Payment and Insufficient Funds Fees

Funding Circle charges fees for late payments and insufficient funds, which can add to the overall cost of the loan.

By considering the potential drawbacks of a Funding Circle loan, you can make an informed decision about whether it’s the right financing option for your business.

Alternatives to Funding Circle Loans

If you’ve decided that a Funding Circle loan isn’t the right financing option for your business, there are several alternatives to consider. Here are some of the most popular alternatives to Funding Circle loans:

Traditional Bank Loans

Traditional bank loans are a popular financing option for small businesses. While they may have stricter eligibility requirements than Funding Circle, they often offer lower interest rates and longer repayment terms.

Small Business Administration (SBA) Loans

SBA loans are guaranteed by the government and offer competitive interest rates and flexible repayment terms. While the application process can be lengthy, SBA loans are a popular financing option for small businesses.

Online Business Loans

Online business loans are a popular financing option for small businesses that need fast access to capital. While they may have higher interest rates than traditional bank loans, they often have looser eligibility requirements and a faster application process.

Business Credit Cards

Business credit cards are a popular financing option for small businesses that need to make regular purchases. They often offer rewards and cashback incentives, but may have higher interest rates than other financing options.

Crowdfunding

Crowdfunding is a popular way for small businesses to raise funds through online platforms. While it may require a lot of marketing and promotion, crowdfunding can provide access to capital without the need for traditional financing.

By exploring these alternatives to Funding Circle loans, you can find the right financing option for your business.

How Funding Circle Loans Compare to Traditional Bank Loans

If you’re considering a Funding Circle loan for your small business, it’s important to understand how it compares to traditional bank loans. Here are some of the key differences between Funding Circle loans and traditional bank loans:

Eligibility Requirements

Funding Circle loans have slightly looser eligibility requirements than traditional bank loans, but still require a minimum credit score of 620 and a minimum of two years in business. Traditional bank loans may have stricter eligibility requirements, such as a higher credit score and a longer time in business.

Application Process

Funding Circle loans have a faster and easier application process than traditional bank loans, with most applicants receiving a decision within 24 hours. Traditional bank loans may require more documentation and a longer approval process.

Interest Rates

Funding Circle loans offer competitive interest rates that are often lower than traditional bank loans, especially for small businesses with lower credit scores.

Loan Amounts

Funding Circle loans offer loan amounts up to $500,000, while traditional bank loans may offer larger loan amounts depending on the business’s creditworthiness and financial history.

Repayment Terms

Funding Circle loans offer flexible repayment terms that range from six months to five years, while traditional bank loans may have longer repayment terms and require collateral.

Fees

Funding Circle charges an origination fee on its loans, while traditional bank loans may have other fees such as application fees, appraisal fees, and early repayment fees.

By understanding the differences between Funding Circle loans and traditional bank loans, you can make an informed decision about the best financing option for your small business.

How to Maximize Your Chances of Getting Approved for a Funding Circle Loan

If you’re interested in applying for a Funding Circle loan, there are several things you can do to increase your chances of getting approved. Here are some tips for maximizing your chances of approval:

1. Improve Your Credit Score

Funding Circle requires a minimum credit score of 620, but having a higher score can increase your chances of approval and lower your interest rate. Take steps to improve your credit score by paying off outstanding debts and ensuring that all of your credit accounts are in good standing.

2. Have a Solid Business Plan

Funding Circle wants to see that your business has a solid plan for growth and that you have a clear understanding of your financials. Be prepared to provide a detailed business plan that includes financial projections and a breakdown of how the loan funds will be used.

3. Provide Accurate and Complete Documentation

Funding Circle requires documentation such as tax returns, bank statements, and financial statements as part of the application process. Make sure that you provide accurate and complete documentation to avoid delays in the approval process.

4. Demonstrate Your Ability to Repay the Loan

Funding Circle wants to see that you have a steady cash flow and the ability to repay the loan on time. Be prepared to provide evidence of your business’s financial stability and ability to generate revenue.

5. Consider a Co-Signer or Collateral

If you have a lower credit score or limited business history, you may consider a co-signer or collateral to increase your chances of approval. A co-signer can provide additional financial security, while collateral can provide a way for Funding Circle to recover the loan funds if you default.

By following these tips, you can increase your chances of getting approved for a Funding Circle loan and secure the financing your small business needs to grow.

What is Funding Circle?

Funding Circle is a peer-to-peer lending platform that provides loans to small businesses. Investors can lend money to small businesses and earn interest on their investment.

What types of loans does Funding Circle offer?

Funding Circle offers term loans and lines of credit to small businesses. These loans can be used for a variety of purposes, such as working capital, equipment purchases, and expansion.

What are the eligibility requirements for a Funding Circle loan?

To be eligible for a Funding Circle loan, your business must have been in operation for at least two years, have a minimum credit score of 620, and generate at least $150,000 in annual revenue.

How much can I borrow with a Funding Circle loan?

Funding Circle offers loans up to $500,000 for small businesses.

How long does it take to get approved for a Funding Circle loan?

Most applicants receive a decision within 24 hours of submitting their application.

What are the repayment terms for a Funding Circle loan?

Repayment terms for Funding Circle loans range from 6 months to 5 years.

Are there any fees associated with a Funding Circle loan?

Yes, Funding Circle charges an origination fee on its loans, which ranges from 3.49% to 6.99% of the loan amount.

What happens if I can’t repay my Funding Circle loan?

If you’re unable to make your loan payments, Funding Circle may take legal action to recover the funds. It’s important to contact Funding Circle as soon as possible if you’re having difficulty making payments.

How does Funding Circle compare to traditional bank loans?

Funding Circle loans offer faster approval times and competitive interest rates compared to traditional bank loans. However, traditional bank loans may offer larger loan amounts and longer repayment terms.

Is Funding Circle a reputable lender?

Yes, Funding Circle is a reputable lender with a positive reputation in the industry. They have an A+ rating with the Better Business Bureau and have provided loans to thousands of small businesses.