Are you considering a mortgage but uncertain about the best rate for your situation? A blended rate mortgage calculator is a great tool to help you figure out the perfect rate for your home loan. It allows you to mix and match different rates and terms to find the one that best fits your budget and lifestyle. This type of calculator not only makes it easier to understand different types of mortgages, but also helps you determine which one is right for you.

Do you want to know what your blended rate mortgage payments will be? A blended rate mortgage calculator can help you determine the amount of your monthly payments. This type of mortgage is a combination of an adjustable and fixed-rate loan, which gives borrowers the best of both worlds.

The adjustable portion carries a lower interest rate, while the fixed-rate loan element provides security for those who can’t afford to take on too much risk. The two loan amounts combine to create one total loan amount with one single payment. By using a blended rate mortgage calculator, you can accurately predict how much your monthly payment will be by inputting different scenarios into the tool. With this information in hand, it becomes easier for borrowers to make intelligent decisions about their financing choices and plan out their budget accordingly.

Blended Rate Mortgage Calculator

A blended rate mortgage calculator is a tool that helps homeowners estimate the cost of a mortgage loan that combines two or more loans with different interest rates into one. Here is an example

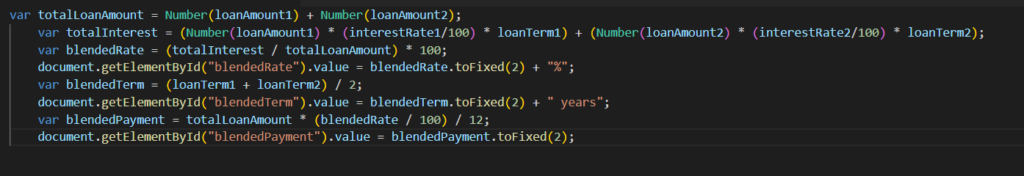

It then calculates the blended interest rate, blended loan term and blended monthly payment.

Blended Rate Mortgage Calculator Logic