A bridge loan mortgage calculator is a tool that helps homeowners estimate the cost of a short-term loan used to finance the purchase of a new property before selling their current home.

Looking to calculate the monthly payments associated with a bridge loan mortgage? This article will introduce you to the concept of a bridge loan mortgage calculator and provide an overview of how it works. A bridge loan mortgage is a type of short-term financing used to cover gaps between transactions when buying and selling property; this calculator helps you determine the cost associated with these loans.

Are you looking to bridge the gap between buying and selling your homes? If so, a bridge loan mortgage calculator can help you determine the best loan option for your situation.

A bridge loan is a short-term loan that provides funding while the borrower waits on other financing options or sells an existing property. It allows borrowers to have access to cash without having to wait months for long-term financing to be approved. Bridge loans typically range from 1-2 years and are typically used by homeowners who need to purchase their new home before they sell their existing residence.

Bridge Loan Mortgage Calculator

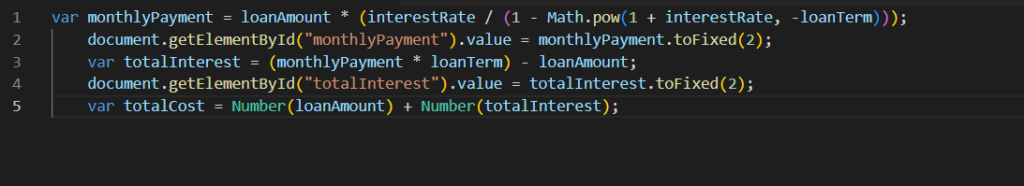

Bridge Loan Mortgage Calculator logic