Securing a VA loan can be daunting but the process doesn’t have to be. With the right tools and knowledge, you can get an accurate estimate of your pre-approval amount quickly and easily. A great place to start is with a VA loan pre-approval calculator. This calculator helps to estimate how much home you can afford based on your eligibility for a VA loan and other factors such as income, down payment, and monthly debt payments.

VA Loan Pre Approval Calculator – A Must-Have for Home Buyers.

For home buyers looking to purchase a home with a VA loan, one of the most important tools needed is a VA Loan Pre Approval Calculator. This calculator helps potential home buyers determine what type of loan they qualify for, as well as how much they can afford to borrow and whether or not their credit score will be sufficient to secure the loan. The calculator takes into account factors such as income, credit score, debt-to-income ratio, employment history, and more in order to provide an accurate assessment of what type of loan a buyer may qualify for.

The VA Loan Pre Approval Calculator can also help potential home buyers determine if they are eligible for any special programs that may lower their interest rate on the loan or provide other financial benefits.

When it comes to buying a home, financing is a crucial factor that can significantly impact the affordability and the decision-making process. Fortunately, for those who served or are currently serving in the military, a VA loan can be a great option to consider. However, before applying for a VA loan, it’s important to get pre-approved, which can help determine your eligibility and the amount you can afford. This is where a VA loan pre-approval calculator comes into play. In this article, we’ll explore the ins and outs of VA loan pre-approval calculator with interest rates and down payments, and how it can help simplify the process of securing a VA loan.

What is a VA Loan Pre-Approval Calculator?

A VA loan pre-approval calculator is a tool designed to help military personnel, veterans, and their families estimate the mortgage payments and determine the amount they can afford for a home purchase. It provides a quick and easy way to get pre-approved for a VA loan by taking into account various factors, such as interest rates and down payments, to help borrowers determine their eligibility and affordability.

Definition and Explanation

A VA loan pre-approval calculator is an online tool that allows borrowers to estimate their monthly mortgage payments, as well as the maximum loan amount they can qualify for. It takes into account various factors such as the borrower’s income, credit score, debt-to-income ratio, and other financial information to provide an accurate estimate.

Benefits of Using a VA Loan Pre-Approval Calculator

Using a VA loan pre-approval calculator has several benefits, including:

- Saves Time: Instead of manually calculating the mortgage payments and loan amount, a VA loan pre-approval calculator provides quick and accurate results in just a few minutes.

- Provides Accurate Estimates: By taking into account various factors, a VA loan pre-approval calculator can provide an accurate estimate of the mortgage payments and loan amount that borrowers can afford.

- Helps Determine Affordability: A VA loan pre-approval calculator can help borrowers determine their affordability by taking into account their income, expenses, and debt-to-income ratio.

- Helps in Decision-Making: By providing accurate estimates, a VA loan pre-approval calculator can help borrowers make informed decisions about the type and size of the home they can afford.

How It Works

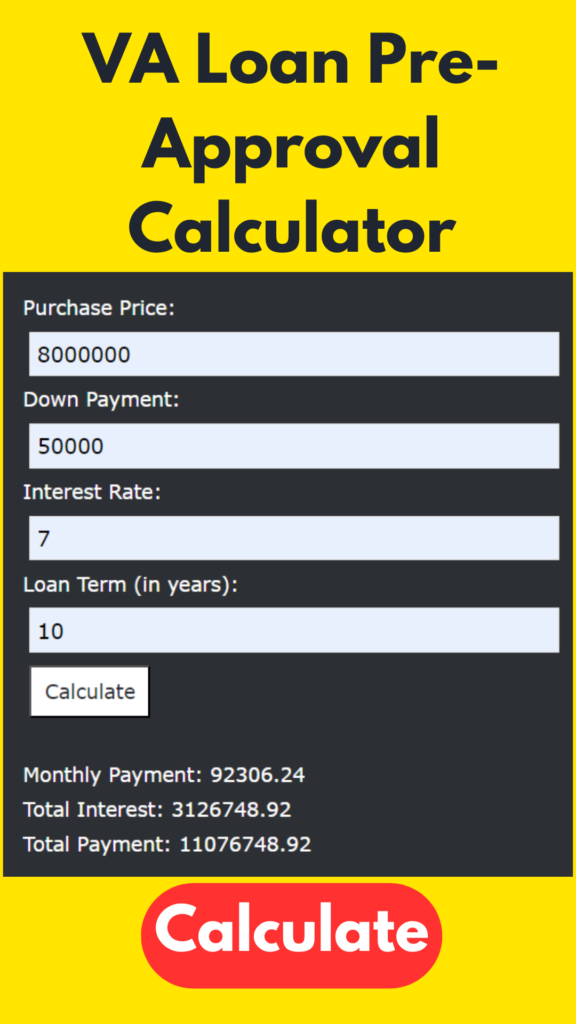

A VA loan pre-approval calculator works by taking into account various factors, such as the borrower’s income, credit score, debt-to-income ratio, and other financial information. The borrower enters this information into the calculator, along with the desired loan term, interest rate, and down payment. The calculator then provides an estimate of the maximum loan amount and the monthly mortgage payments based on the entered information.

VA Loan Pre-Approval Calculator

VA Loan Pre-Approval Calculator Logic

How to Use a VA Loan Pre-Approval Calculator

Using a VA loan pre-approval calculator is a straightforward process that involves a few simple steps. Here’s how to use it:

Step 1: Gather the Required Information

Before using the VA loan pre-approval calculator, borrowers must gather the following information:

- Gross monthly income: This includes all sources of income, such as salary, bonuses, and commissions.

- Monthly debt payments: This includes all monthly debt payments, such as credit card debt, car loans, and student loans.

- Estimated property taxes: The annual property tax is divided by 12 to determine the monthly amount.

- Estimated homeowner’s insurance: The annual homeowner’s insurance premium is divided by 12 to determine the monthly amount.

- Desired loan term: The loan term is the length of time borrowers have to pay off the loan, usually 15 or 30 years.

- Estimated interest rate: The interest rate is the annual percentage rate (APR) charged by the lender on the loan amount.

- Estimated down payment: The down payment is the upfront payment made by the borrower, expressed as a percentage of the purchase price.

Step 2: Enter the Information Into the Calculator

Once borrowers have gathered the required information, they can enter it into the VA loan pre-approval calculator. The calculator will then use this information to estimate the maximum loan amount and the monthly mortgage payments that borrowers can afford.

Step 3: Review and Adjust the Results

After the calculator provides the estimates, borrowers should review the results and adjust the inputs as necessary to see how it affects the results. For example, increasing the down payment or reducing the loan term can reduce the monthly payments and the overall cost of the loan.

Step 4: Apply for a VA Loan Pre-Approval

Once borrowers have used the calculator to estimate their affordability, they can apply for a VA loan pre-approval from a lender. The pre-approval process involves a credit check and a review of the borrower’s financial information to determine their eligibility and the loan amount they qualify for.

Understanding Interest Rates and Down Payments

When using a VA loan pre-approval calculator, borrowers must consider two critical factors that affect their mortgage payments and affordability: interest rates and down payments.

Interest Rates

An interest rate is the amount charged by the lender on the loan amount, expressed as a percentage of the total loan amount. It is a critical factor that affects the monthly mortgage payments and the overall cost of the loan.

Fixed-Rate vs. Adjustable-Rate Mortgages

Lenders offer two types of interest rates for mortgages: fixed-rate and adjustable-rate.

- Fixed-Rate Mortgages: With a fixed-rate mortgage, the interest rate remains the same throughout the loan term, which typically ranges from 15 to 30 years. It offers stability and predictability as the monthly payments remain the same.

- Adjustable-Rate Mortgages: With an adjustable-rate mortgage, the interest rate changes periodically, usually once a year, depending on the market conditions. The initial interest rate is typically lower than the fixed-rate mortgage but can fluctuate, resulting in unpredictable monthly payments.

Factors Affecting Interest Rates

Several factors affect the interest rates offered by lenders, such as:

- Credit score

- Debt-to-income ratio

- Loan term

- Down payment

- Market conditions

Down Payments

A down payment is the upfront payment made by the borrower to the lender, expressed as a percentage of the purchase price. It is a critical factor that affects the mortgage payments, the loan amount, and the overall cost of the loan.

VA Loan Down Payment Requirements

One of the significant advantages of VA loans is that they do not require a down payment for most borrowers. However, borrowers who have a less than honorable discharge may be required to make a down payment.

Benefits of Making a Down Payment

While VA loans do not require a down payment, making a down payment can have several benefits, such as:

- Lower monthly payments: A higher down payment reduces the loan amount, resulting in lower monthly mortgage payments.

- Lower interest rates: A higher down payment can lower the interest rate offered by the lender, resulting in lower overall loan costs.

- Equity: A higher down payment increases the equity in the home, which can be useful if the borrower decides to sell the home or refinance the loan in the future.

In the next section, we’ll discuss the importance of VA loan pre-approval and the factors that affect VA loan eligibility.

Importance of Pre-Approval

VA loan pre-approval is a critical step in the homebuying process that offers several benefits to borrowers. Here are some reasons why pre-approval is essential:

Determining Eligibility

The pre-approval process involves a thorough review of the borrower’s credit, income, and financial information to determine their eligibility for a VA loan. This helps borrowers understand if they meet the VA loan requirements and how much they can afford to borrow.

Setting Realistic Budgets

Knowing how much borrowers can afford to borrow helps them set realistic budgets for their home search. It prevents them from wasting time and resources on properties they cannot afford and allows them to focus on properties within their budget.

Negotiating Power

Having a pre-approval letter from a lender demonstrates to sellers that borrowers are serious and qualified buyers. It can give borrowers an advantage in a competitive market where sellers may receive multiple offers from other buyers.

Faster Closing Process

Pre-approval can also help expedite the loan closing process. Since much of the borrower’s financial information has already been reviewed during pre-approval, the lender can quickly move forward with underwriting the loan and finalizing the closing process.

Rate Lock

Many lenders offer rate locks during the pre-approval process, which guarantees the interest rate offered for a specific period. This can protect borrowers from interest rate fluctuations during the homebuying process.

Avoiding Disappointment

Finally, pre-approval can help borrowers avoid disappointment later in the homebuying process. It ensures that borrowers do not fall in love with a property they cannot afford or are ineligible to purchase.

Factors That Affect Loan Approval

Several factors can affect a borrower’s eligibility for a VA loan and the loan amount they can qualify for. Here are some critical factors that lenders consider during the loan approval process:

Credit Score

The credit score is a three-digit number that represents a borrower’s creditworthiness based on their credit history. Lenders use this information to determine the borrower’s likelihood of repaying the loan on time. A higher credit score can improve the chances of loan approval and lower the interest rate offered.

Debt-to-Income Ratio

The debt-to-income (DTI) ratio is the percentage of the borrower’s monthly income that goes towards paying debts, such as credit cards, car loans, and student loans. Lenders use this information to determine if the borrower can afford to repay the loan on time while managing their existing debts. A lower DTI ratio can improve the chances of loan approval.

Employment and Income

Lenders consider the borrower’s employment history and income to determine their ability to repay the loan. A stable employment history and consistent income can improve the chances of loan approval.

Loan Amount and Loan Term

The loan amount and term affect the monthly mortgage payments and the overall cost of the loan. Lenders consider these factors to determine the borrower’s ability to repay the loan.

Down Payment

While VA loans do not require a down payment for most borrowers, making a down payment can improve the borrower’s chances of loan approval. It can also lower the monthly mortgage payments and the overall cost of the loan.

Property Appraisal

Lenders require a property appraisal to determine the market value of the property and ensure it meets the VA’s minimum property requirements. A low appraisal value can affect the loan amount and the borrower’s ability to qualify for the loan.

VA Loan Limits and Entitlements

VA loan limits and entitlements can affect the loan amount borrowers can qualify for. The VA loan limit is the maximum loan amount that the VA will guarantee, and the entitlement is the amount that the VA will guarantee the loan. Borrowers can determine their entitlement by contacting the VA or using a VA loan pre-approval calculator.

VA Loan Pre-Approval Calculator vs Traditional Loan Calculators

When it comes to calculating loan payments and affordability, borrowers have several options, including traditional loan calculators and VA loan pre-approval calculators. Here are some key differences between the two:

Traditional Loan Calculators

Traditional loan calculators are online tools that help borrowers estimate their monthly mortgage payments based on the loan amount, interest rate, and loan term. These calculators do not require the borrower’s financial information, and the results are only estimates.

Pros

- Easy to use

- Can help borrowers estimate monthly mortgage payments quickly

- Available for all types of loans

Cons

- Do not consider the borrower’s financial information

- Results are only estimates and may not reflect actual mortgage payments

VA Loan Pre-Approval Calculators

VA loan pre-approval calculators are online tools that help borrowers determine their eligibility for a VA loan and estimate their monthly mortgage payments. These calculators require the borrower’s financial information, such as income, debts, and credit score, and provide more accurate estimates of mortgage payments.

Pros

- Consider the borrower’s financial information for more accurate estimates

- Help borrowers determine their eligibility for a VA loan

- Some calculators offer rate locks during the pre-approval process

Cons

- Only applicable to VA loans

- Results may vary depending on the lender’s underwriting process

Overall, VA loan pre-approval calculators offer several benefits to borrowers, such as accurate estimates, eligibility determination, and rate locks during the pre-approval process. However, traditional loan calculators can also be useful for estimating monthly mortgage payments quickly, although they do not consider the borrower’s financial information.

Alternatives to VA Loans

While VA loans offer several benefits to eligible veterans and active-duty military members, such as no down payment and lower interest rates, they may not be the best option for everyone. Here are some alternatives to VA loans that borrowers may consider:

Conventional Loans

Conventional loans are not guaranteed by the government and are offered by private lenders. These loans typically require a higher down payment and have stricter credit score and income requirements than VA loans. However, borrowers with excellent credit and a stable income may qualify for lower interest rates than VA loans.

FHA Loans

FHA loans are guaranteed by the Federal Housing Administration (FHA) and offer low down payment options for borrowers with lower credit scores and income levels. However, FHA loans require mortgage insurance premiums, which increase the monthly mortgage payments.

USDA Loans

USDA loans are guaranteed by the United States Department of Agriculture (USDA) and offer low to no down payment options for borrowers in rural and suburban areas. These loans also have lower credit score and income requirements than conventional loans but require mortgage insurance premiums.

Jumbo Loans

Jumbo loans are larger than the conforming loan limits set by Fannie Mae and Freddie Mac and are typically used to finance higher-priced homes. These loans require a higher down payment and have stricter credit score and income requirements than VA loans.

Personal Loans

Personal loans are unsecured loans that can be used for various purposes, such as home improvements or debt consolidation. These loans typically have higher interest rates than VA loans and may require a higher credit score and income level.

Before choosing a loan type, borrowers should consider their financial situation, credit score, and loan needs. It’s also recommended to shop around and compare rates and fees from different lenders to find the best loan option.

Frequently Asked Questions (FAQs)

Who is eligible for a VA loan?

Veterans, active-duty military members, National Guard members, reservists, and some surviving spouses may be eligible for a VA loan. Specific eligibility requirements may vary depending on the length and type of service.

How much can I borrow with a VA loan?

The maximum amount that a borrower can borrow with a VA loan depends on the county loan limit set by the Department of Veterans Affairs (VA) and the borrower’s entitlement. In 2021, the maximum loan limit for most counties was $548,250 for a single-family home.

How does the VA loan pre-approval process work?

The VA loan pre-approval process involves submitting a loan application and providing financial information, such as income, debts, and credit score, to a VA-approved lender. The lender will then review the application and determine the borrower’s eligibility for a VA loan and the maximum loan amount. Some lenders may also offer rate locks during the pre-approval process.

Can I use a VA loan to buy a second home?

Yes, a VA loan can be used to buy a second home, but the borrower must intend to occupy the property as their primary residence. The VA loan may also have a higher funding fee for subsequent use.

What happens if I can’t make my VA loan payments?

If a borrower is unable to make their VA loan payments, they should contact their lender as soon as possible to discuss their options. Depending on the situation, the lender may offer forbearance, loan modification, or other options to help the borrower avoid foreclosure.