For many students, the burden of student loan debt can feel overwhelming. Thankfully, refinancing your loans can help reduce payments and save you money in the long run. To help you determine whether or not to refinance, a student loan refinances savings calculator can be used to compare different options and scenarios.

Are you considering refinancing your student loans? Refinancing can be a great way to reduce the overall cost of your loan and save yourself money in the long run. A student loan refinances savings calculator can quickly help you determine how much you stand to gain from refinancing.

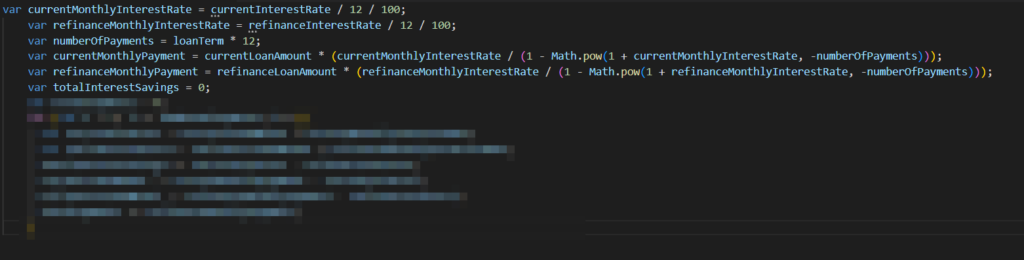

Using a student loan refinance savings calculator is easy and straightforward; simply enter details about your current loan balance, interest rate, monthly payment, and repayment term. The calculator will then compare it with potential new rates and repayment terms that could be available when you refinance your loans. The savings calculator will use this data to instantly generate an estimate of the amount of money you could save by refinancing. This will provide an accurate snapshot so that you can make an informed decision on whether or not refinancing is right for you.

Student Loan Refinance Savings Calculator

Student Loan Refinance Savings Calculator