What is Refinance Reverse Mortgage Calculator

A refinance reverse mortgage calculator is a tool that helps users to estimate the potential savings they could achieve by refinancing their existing reverse mortgage loan.

When considering a refinance of your existing reverse mortgage, it is important to have the right information and resources to make an informed decision. A refinance reverse mortgage calculator can help you to understand your options and determine the best solution for your needs. This article will provide an overview of how a refinance reverse mortgage calculator works, as well as how you can use it to better understand your financial options. We will also discuss some tips on choosing the right calculator for your situation.

Refinancing a reverse mortgage can be an important financial decision and it’s important to know what affects the outcome. A refinance reverse mortgage calculator is a valuable tool for anyone considering refinancing their existing mortgage. This type of calculator provides an easy way to compare different options and estimate the potential savings or costs associated with each option.

The refinance reverse mortgage calculator estimates the impact of various changes on loan terms, loan limits, interest rates, fees and other factors that affect the cost and benefit of refinancing a reverse mortgage. It can also help to compare different lenders’ offers side-by-side, so borrowers can make an informed choice about which lender works best for them.

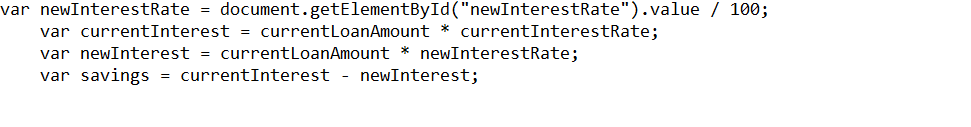

Using this calculator requires inputting information about current loan details such as principal balance, remaining length of loan term, current interest rate and other fees associated with the existing loan.

Refinance Reverse Mortgage Calculator

Refinance Reverse Mortgage Calculator Logic