Are you considering taking out a mortgage? If so, it is important to take into account how inflation can affect the cost of your loan over time. A Mortgage Inflation Calculator can be an invaluable tool to help you estimate the true cost of your loan and plan accordingly. It allows you to calculate the rate of inflation and its impact on your monthly payments. With this calculator, you will be able to identify potential problems with affordability or cash flow before they arise.

Mortgage inflation calculators are an essential tool for homeowners who want to estimate the future cost of their mortgage payments. These calculators allow users to enter data such as current mortgage balance, interest rate, and expected length of time in order to calculate a projected payment amount based on certain assumptions about future inflation. Knowing how much money one may have to shell out each month can help homeowners better plan for the future, allowing them to adjust their budget accordingly.

Inflation is a vital parameter when it comes to estimating a future mortgage payment. Inflation can affect both the interest rate and principal amount due depending on the type of loan taken out – fixed or adjustable rate mortgages – and its duration. Therefore, having access to a reliable mortgage inflation calculator is key for anyone looking into buying a home.

Mortgage Inflation Calculator

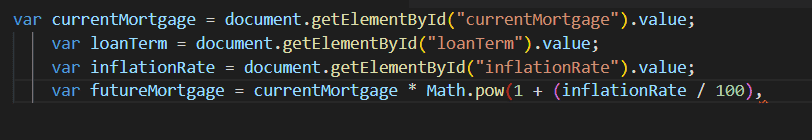

Mortgage Inflation Calculator Logic