A mortgage calculator with a variable interest rate is a tool that helps users to estimate the total monthly payment on a home loan, taking into account the fact that the interest rate may change over time.

Mortgages can be complicated and confusing, especially when you are trying to figure out the best way to save money on your loan. With an ever-changing interest rate market, it is important to have the right tools to help you calculate and compare mortgage options. A mortgage calculator with variable interest rate can be a valuable asset for anyone considering a new home or refinancing their current loan.

Mortgage calculators with variable interest rates make it easy for homebuyers to quickly budget for their future. With a mortgage calculator that offers variable interest rates, consumers can input information such as the loan amount, down payment, current rate and the term of the loan to get an accurate estimate of their monthly payments on a property they’re considering buying. Not only do these tools allow you to compare different loans in real-time, but they also help you anticipate how your monthly payments will change as rates rise or fall throughout the life of your loan.

A mortgage calculator with variable interest rate is especially useful when shopping around for various lenders and mortgages. It can give borrowers a sense of what type of loans are available and how much each one may cost them over time.

Mortgage Calculator with Variable Interest Rate

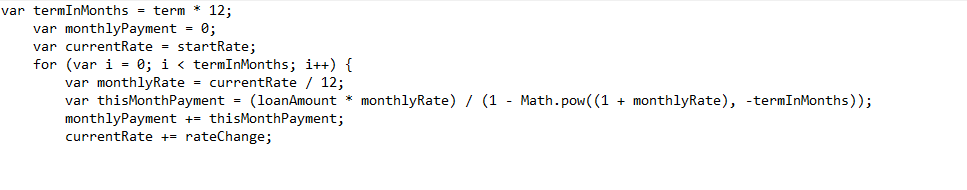

Mortgage Calculator with Variable Interest Rate Logic