Gold Loans have been utilized by individuals for centuries to get quick and easy access to finances. With the current economic situation, these loans are becoming increasingly popular as a way to secure funding without having to take on more debt. With so many people turning to gold loans for their financial needs, understanding the details of gold loan interest rate is essential. This article will provide an overview of what a gold loan interest rate is, how it works and which factors can affect the rate.

Deep Dive into Gold Loan Calculator With Loan Rate and Gold Purity

Gold loan interest rate is a major factor when considering whether to take out a gold loan. It can be difficult to determine the exact rate that you’ll be charged as it varies depending on the lender and other factors. However, understanding how gold loan interest rates work can help you make an informed decision about your financing.

Generally speaking, the higher the value of your gold, the lower your interest rate will be. Lenders base their assessments of risk on the quality and amount of gold being used as collateral, so if you have high-quality gold with good resale value, then you’re more likely to get a better deal with a lower interest rate. Different lenders offer different rates and some may even negotiate with customers for an even more attractive deal depending on their financial situation and creditworthiness.

Introduction:

Gold is a precious metal that has been used as a form of currency and investment for centuries. In recent times, it has also become a popular asset for securing loans. A gold loan is a type of secured loan where the borrower pledges their gold as collateral. The loan amount is usually a percentage of the gold’s value, and the borrower is required to pay interest on the loan amount. The interest rate on a gold loan is determined by several factors, including the gold’s purity and weight. Understanding how these factors influence the interest rate is important for borrowers looking to secure a gold loan. In this article, we will delve into the relationship between gold purity and weight and the interest rate charged on gold loans. We will also explore other factors that influence gold loan interest rates and provide tips on how to get the best interest rate on a gold loan.

Deep Dive into PayPal Working Capital Loan Calculator With Daily Sales Volume

Gold Loan Interest Rate

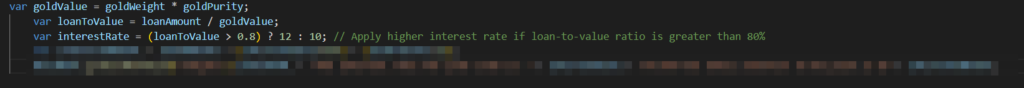

Gold Loan Interest Rate logic

Understanding Gold Purity:

Gold purity refers to the amount of gold present in a piece of gold jewelry or other items. Gold purity is measured in karats (K), with 24 karat gold being the purest form of gold. 22 karat gold contains 22 parts of gold and 2 parts of other metals, while 18 karat gold contains 18 parts of gold and 6 parts of other metals.

The purity of gold affects its value, with higher purity gold being more valuable than lower purity gold. When it comes to gold loans, the purity of the gold pledged as collateral is an important factor in determining the interest rate charged on the loan. Higher purity gold generally attracts a lower interest rate compared to lower purity gold. Therefore, it is important to know the purity of the gold you intend to pledge as collateral to get the best interest rate on a gold loan. Testing the purity of gold can be done using various methods, including acid testing and X-ray fluorescence testing.

Impact of Gold Purity on Interest Rates:

The purity of the gold pledged as collateral can have a significant impact on the interest rate charged on a gold loan. Below are some of the ways gold purity affects gold loan interest rates:

- Higher Purity Gold Attracts Lower Interest Rates:

- Lenders prefer higher purity gold as collateral because it is more valuable and easier to sell in case of default.

- Higher purity gold also has a lower risk of corrosion or tarnishing, making it easier to store and maintain.

- As a result, lenders are willing to offer lower interest rates on gold loans secured with higher purity gold.

- Lower Purity Gold Attracts Higher Interest Rates:

- Lower purity gold, such as 18K or 14K gold, has a higher percentage of other metals, making it less valuable than higher purity gold.

- Lower purity gold is also more susceptible to corrosion and tarnishing, making it less attractive to lenders as collateral.

- As a result, lenders may charge higher interest rates on gold loans secured with lower purity gold.

- Impact of Gold Purity on Loan-to-Value Ratio:

- The loan-to-value (LTV) ratio is the percentage of the gold’s value that the lender is willing to lend.

- Higher purity gold typically has a higher value, which means borrowers may be able to secure a higher loan amount with the same weight of gold.

- As a result, borrowers may be able to negotiate a lower interest rate if they pledge higher purity gold with a higher loan-to-value ratio.

Overall, the purity of the gold pledged as collateral is an important factor in determining the interest rate charged on a gold loan. Borrowers should aim to pledge higher purity gold to get the best interest rates and loan terms.

Understanding Gold Weight:

The weight of the gold pledged as collateral is another important factor that influences the interest rate charged on a gold loan. Below are some of the ways gold weight affects gold loan interest rates:

- Loan Amount Depends on Gold Weight:

- The loan amount offered by the lender is usually a percentage of the gold’s value, which is determined by its weight and purity.

- Higher weight gold can result in a higher loan amount, which may attract a lower interest rate.

- However, borrowers should be cautious not to pledge more gold than necessary to avoid paying unnecessary interest charges.

- Impact of Gold Weight on LTV Ratio:

- The loan-to-value (LTV) ratio also depends on the weight of the gold pledged as collateral.

- A higher weight of gold can result in a higher loan-to-value ratio, which may attract a lower interest rate.

- However, as with loan amount, borrowers should aim to pledge only the necessary amount of gold to avoid paying unnecessary interest charges.

- Storage and Security Costs:

- Lenders may factor in the storage and security costs of storing and securing the gold pledged as collateral.

- Higher weight gold may require more storage space and better security measures, which may result in higher interest rates.

- Impact of Gold Weight on Processing Fees:

- Some lenders may charge processing fees based on the weight of the gold pledged as collateral.

- Higher weight gold may result in higher processing fees, which may increase the overall cost of the loan.

Overall, the weight of the gold pledged as collateral is an important factor in determining the interest rate charged on a gold loan. Borrowers should aim to pledge the necessary amount of gold to get the best loan terms and avoid paying unnecessary interest charges.

Impact of Gold Weight on Interest Rates:

The weight of the gold pledged as collateral can have a significant impact on the interest rate charged on a gold loan. Below are some of the ways gold weight affects gold loan interest rates:

- Higher Weight Gold May Attract Lower Interest Rates:

- Borrowers who pledge higher weight gold may be able to secure a higher loan amount, which can result in a lower interest rate.

- Lenders may be more willing to offer lower interest rates on gold loans secured with higher weight gold due to the higher value of the collateral.

- Impact of Gold Weight on LTV Ratio:

- The loan-to-value (LTV) ratio also depends on the weight of the gold pledged as collateral.

- A higher weight of gold can result in a higher loan-to-value ratio, which may attract a lower interest rate.

- However, borrowers should aim to pledge only the necessary amount of gold to avoid paying unnecessary interest charges.

- Storage and Security Costs:

- Lenders may factor in the storage and security costs of storing and securing the gold pledged as collateral.

- Higher weight gold may require more storage space and better security measures, which may result in higher interest rates.

- Impact of Gold Weight on Processing Fees:

- Some lenders may charge processing fees based on the weight of the gold pledged as collateral.

- Higher weight gold may result in higher processing fees, which may increase the overall cost of the loan.

Overall, the weight of the gold pledged as collateral is an important factor in determining the interest rate charged on a gold loan. Borrowers should aim to pledge the necessary amount of gold to get the best loan terms and avoid paying unnecessary interest charges. Lenders may offer lower interest rates for higher weight gold, but borrowers should be cautious not to pledge more gold than necessary to avoid paying higher processing fees and storage costs.

Understanding Loan-to-Value Ratio

The loan-to-value (LTV) ratio is a financial term used by lenders to assess the risk associated with a loan. In the context of gold loans, the LTV ratio represents the percentage of the gold’s value that the lender is willing to lend to the borrower. Typically, the LTV ratio for gold loans ranges from 60% to 90%, depending on the lender and the borrower’s creditworthiness.

The LTV ratio is determined by dividing the loan amount by the appraised value of the gold pledged as collateral. For example, if the appraised value of the gold is $10,000 and the lender offers a loan of $6,000, the LTV ratio would be 60%. A higher LTV ratio indicates a higher risk for the lender, and may result in a higher interest rate or stricter loan terms. Borrowers should aim to borrow within their means and avoid pledging more gold than necessary to keep the LTV ratio low and secure favorable loan terms.

Impact of Loan-to-Value Ratio on Interest Rates:

The loan-to-value (LTV) ratio plays a significant role in determining the interest rate charged on a gold loan. Below are some of the ways the LTV ratio affects gold loan interest rates:

- Lower LTV Ratio May Attract Lower Interest Rates:

- A lower LTV ratio indicates that the borrower is pledging a higher amount of gold as collateral compared to the loan amount.

- This results in lower risk for the lender, which may attract a lower interest rate.

- Higher LTV Ratio May Result in Higher Interest Rates:

- A higher LTV ratio indicates that the borrower is pledging a lower amount of gold as collateral compared to the loan amount.

- This results in higher risk for the lender, which may result in a higher interest rate.

- Some lenders may offer higher interest rates to compensate for the higher risk associated with a higher LTV ratio.

- Impact of LTV Ratio on Loan Amount:

- The LTV ratio also determines the maximum loan amount that the borrower can receive.

- A lower LTV ratio may result in a lower loan amount, which may not meet the borrower’s financial needs.

- On the other hand, a higher LTV ratio may result in a higher loan amount, which may attract a higher interest rate.

- Creditworthiness of the Borrower:

- Lenders may also consider the creditworthiness of the borrower when determining the interest rate charged on a gold loan.

- A borrower with a good credit history may be able to negotiate a lower interest rate even with a higher LTV ratio, as they are considered to be lower risk borrowers.

Factors That Determine Gold Loan Interest Rate

Several factors determine the interest rates charged on gold loans. Some of these factors include:

- Loan-to-Value (LTV) Ratio: The LTV ratio is a significant determinant of gold loan interest rates. Lenders consider the amount of gold being pledged as collateral compared to the loan amount. A higher LTV ratio increases the risk for the lender, which may result in higher interest rates.

- Gold Purity: The purity of the gold pledged as collateral can also affect the interest rates charged on gold loans. Higher purity gold attracts lower interest rates, while lower purity gold may result in higher interest rates.

- Gold Weight: The weight of the gold pledged as collateral is another significant factor in determining gold loan interest rates. A higher weight of gold may result in lower interest rates, while a lower weight of gold may result in higher interest rates.

- Market Conditions: Interest rates on gold loans are also influenced by market conditions. Fluctuations in gold prices and other economic factors may result in changes in interest rates charged by lenders.

- Tenure of the Loan: The tenure of the loan is another factor that determines gold loan interest rates. Longer loan tenures may result in higher interest rates, while shorter tenures may attract lower interest rates.

- Creditworthiness of the Borrower: The creditworthiness of the borrower is also considered by lenders when determining the interest rates charged on gold loans. Borrowers with good credit histories may be able to secure lower interest rates even with a higher LTV ratio.

Overall, borrowers should aim to understand these factors and negotiate for favorable loan terms that suit their financial needs. It is essential to research and compare different lenders and their gold loan interest rates before making a decision.

How to Get the Best Gold Loan Interest Rate

To get the best gold loan interest rate, borrowers should follow these tips:

- Research Different Lenders: Conduct research to find out which lenders offer the best gold loan interest rates. Compare the interest rates, LTV ratio, and other loan terms to make an informed decision.

- Choose High-Purity Gold: Choose high-purity gold as collateral to get the best interest rates. Lenders consider higher purity gold to be of lower risk, resulting in lower interest rates.

- Offer a Higher Gold Weight: Offer a higher gold weight as collateral to secure favorable loan terms. Lenders may offer lower interest rates for higher weights of gold pledged as collateral.

- Maintain a Good Credit History: A good credit history can help borrowers negotiate lower interest rates even with a higher LTV ratio.

- Negotiate with the Lender: Negotiate with the lender to secure favorable loan terms. Discuss the loan terms, including interest rates, LTV ratio, and tenure of the loan, to get the best deal.

- Avoid Borrowing Beyond Your Needs: Borrow within your means and avoid borrowing more than necessary. Borrowing beyond your needs may result in higher interest rates and increase the risk of defaulting on the loan.

- Repay the Loan on Time: Repay the loan on time to avoid penalties and additional charges. Timely repayments can help borrowers maintain a good credit history and secure lower interest rates in the future.

Risks of Gold Loans

Gold loans may come with certain risks that borrowers should be aware of before taking out a loan. Some of these risks include:

- Risk of Losing the Collateral: One of the most significant risks associated with gold loans is the risk of losing the collateral. If the borrower is unable to repay the loan, the lender may auction off the gold pledged as collateral to recover their money.

- Risk of Lowering Credit Score: Defaulting on a gold loan can significantly lower the borrower’s credit score. This can affect their ability to obtain loans or credit in the future.

- Risk of Higher Interest Rates: Failing to repay the loan on time may result in additional charges and penalties, leading to higher interest rates. Borrowers should ensure that they can repay the loan on time to avoid such risks.

- Risk of Fraud: There is a risk of fraud when dealing with unscrupulous lenders. Borrowers should conduct thorough research and deal only with reputable lenders to avoid such risks.

- Risk of Fluctuating Gold Prices: Gold prices can be volatile and may fluctuate significantly, which can impact the value of the collateral. Borrowers should be aware of the potential risks of market fluctuations when taking out a gold loan.

- Risk of Hidden Charges: Some lenders may have hidden charges that borrowers may not be aware of. It is essential to read the loan agreement carefully and understand all the terms and conditions before signing.

Conclusion

Gold loans can be an excellent option for individuals looking to access quick funds without going through the hassle of traditional loan applications. However, before taking out a gold loan, it is essential to understand the factors that determine the interest rates, including gold purity, gold weight, and loan-to-value ratio. Borrowers should also be aware of the risks associated with gold loans, such as the risk of losing the collateral, lower credit scores, and hidden charges.

To get the best gold loan interest rates, borrowers should conduct thorough research, choose reputable lenders, and negotiate favorable loan terms. Borrowing within their means and repaying the loan on time can help borrowers maintain a good credit history and secure lower interest rates in the future.

In conclusion, gold loans can be an excellent option for those who need quick access to funds. However, borrowers should be aware of the risks and take steps to mitigate them to ensure that they make informed decisions and choose the best loan terms for their financial needs.

What is a gold loan?

A gold loan is a secured loan that involves pledging gold as collateral to obtain funds from a lender. The loan amount is determined based on the value of the gold pledged.

What is the loan-to-value ratio for gold loans?

The loan-to-value ratio for gold loans varies by lender but typically ranges from 60% to 80% of the value of the gold pledged.

How is the interest rate for a gold loan determined?

The interest rate for a gold loan is determined based on various factors, including the loan-to-value ratio, gold purity, and loan amount.

What happens if I am unable to repay the gold loan?

If you are unable to repay the gold loan, the lender may auction off the gold pledged as collateral to recover their money.

Can I get my gold back after repaying the gold loan?

Yes, you can get your gold back after repaying the gold loan, including the interest and any other charges.

Is it safe to take a gold loan from any lender?

No, it is not safe to take a gold loan from any lender. Borrowers should conduct thorough research and choose reputable lenders to avoid fraudulent activities.